Home> Home Surveillance

Home Surveillance

How To Install Hard Wired Security Cameras From Ring

By: Emma Thompson • Home Security and Surveillance

How Can I Monitor My Wired Security Cameras From Bunker Hill On My iPhone

By: Grace Wilson • Home Security and Surveillance

Why Does My Wired Security DVR and Wired Cameras Say “Video Loss”?

By: Ethan Hayes • Home Security and Surveillance

How to Identify A Newly Pre-Wired Home Security System

By: William Harrison • Home Security and Surveillance

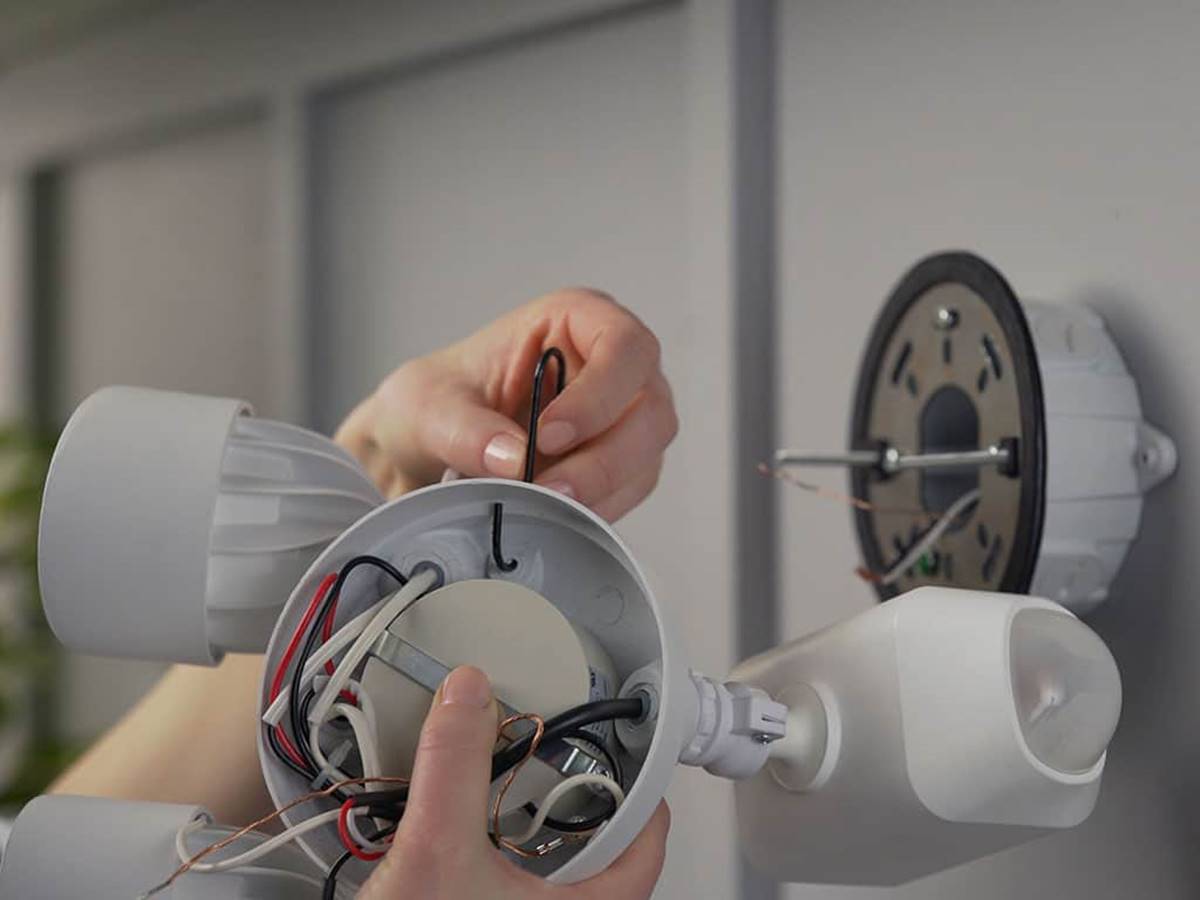

How To Install Long-Distance Wired Security Cameras

By: Grace Wilson • Home Security and Surveillance

How To Put Wired Security Cameras Outdoor

By: Noah Bennett • Home Security and Surveillance

Why Does My Home Security Start Beeping When The Power Goes Out

By: Henry Campbell • Home Security and Surveillance

How Much Does A Home Security System Cost

By: Emma Thompson • Home Security and Surveillance

Where Were Home Security Systems First Made

By: James Anderson • Home Security and Surveillance

What To Do With Samsung SmartThings Home Security Kit

By: William Harrison • Home Security and Surveillance

How To Use Pre-wired Home Security With Smart Sensor

By: Henry Campbell • Home Security and Surveillance

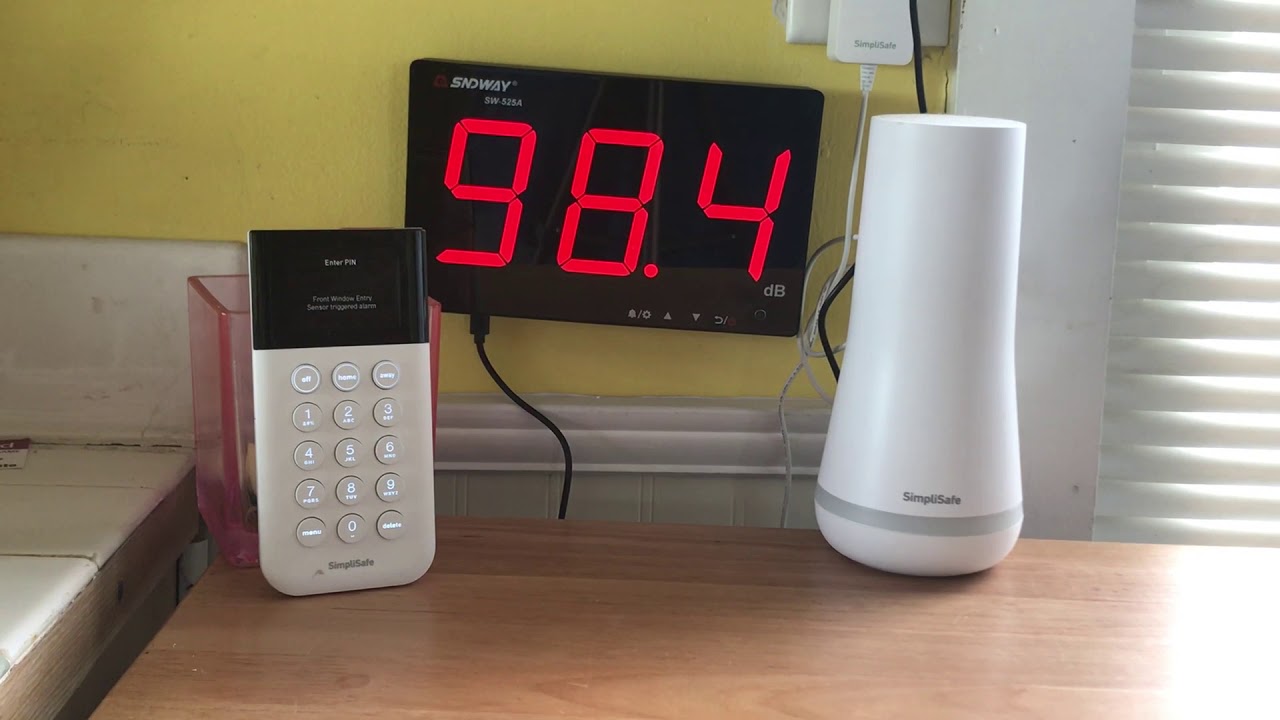

Which Home Security System Allows Arming Specific Zones

By: Henry Campbell • Home Security and Surveillance

How To Remove Security Hardware From Guardian Home Security

By: Henry Campbell • Home Security and Surveillance

What Does Abode Home Security Work With

By: Alexander Johnson • Home Security and Surveillance

How To Use Defiant Wireless Home Security Door And Window Alarm

By: Isabella Mitchell • Home Security and Surveillance

Importance Of Home Security When Renting

By: Sophia Turner • Home Security and Surveillance

What Is The Best Round For AR For Home Defense

By: Grace Wilson • Home Security and Surveillance

How To Control Pest Using Bomb Foggers And A Home Defense Spray

By: Sophie Thompson • Home Security and Surveillance

How Often To Switch Out Ammo For Home Defense

By: Olivia Parker • Home Security and Surveillance

What Does SWAT Recommend For Home Defense

By: Samuel Turner • Home Security and Surveillance

What Is The Best AR Rifle For Home Defense

By: Alexander Johnson • Home Security and Surveillance